Henan Liyue New Energy Co., Ltd

How to Enter the U.S. Residential Energy Storage Market in 2026

As a long-standing lithium battery manufacturer in the Energiespeicher für Privathaushalte industry, we have a clear view of current trends. Let’s be direct: 2026 will be a turning point for the U.S. residential solar and storage market. The comfortable growth phase is over.

1. The Residential ITC Subsidy Ends

The core problem is simple: the 30% federal Investment Tax Credit (ITC) for homeowners expires at the end of 2025. A new law called the “One Big Beautiful Bill Act” (OBBBA) made this happen.

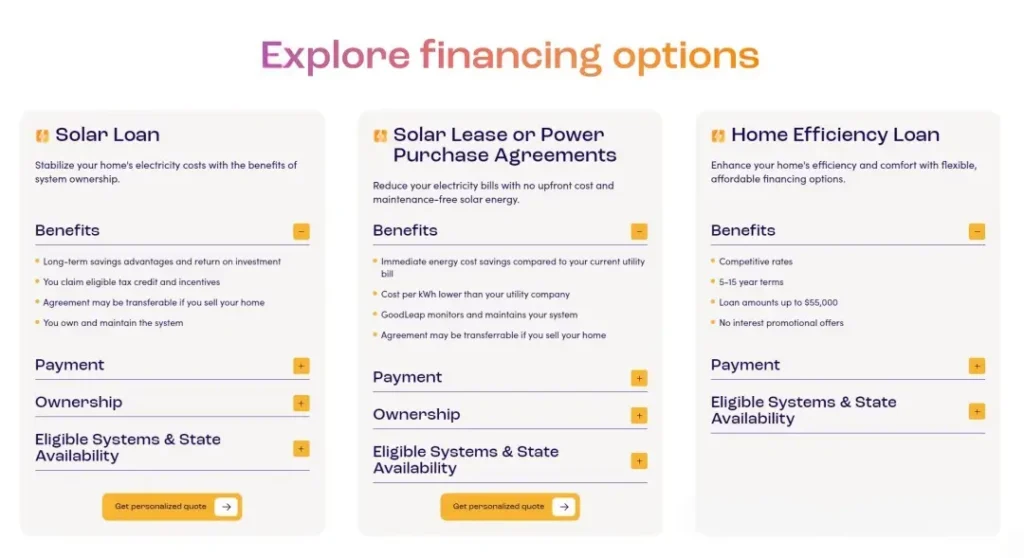

This change breaks the most popular sales model overnight. For years, companies sold systems with “no money down” by using the 30% tax credit to lower the loan cost. This created a lower monthly payment than the old electric bill. Without that tax credit, this “bill swap” trick doesn’t work anymore.

As a result, customer costs will go way up, and demand from people who just wanted to save money will drop. Top research groups like Wood Mackenzie have already cut their growth forecasts for 2025-2029 by 18% to 30%. Also, a big rush to install systems before the deadline in 2025 will steal demand from future years. Therefore, 2026 won’t just be slow; it will feel like the floor dropped out.

2. The Solar Loan Bubble is a Real Risk

However, the subsidy ending might not even be the biggest problem. A more immediate danger is the “solar loan.”

To make loans look cheap with low rates like 2.99%, finance companies charge installers a huge “dealer fee”—sometimes as high as 40%. The installer then adds this fee to the homeowner’s total price. This means the loan is often for much more than the system is actually worth.

This creates a dangerous situation:

- If a homeowner can’t pay, the company can’t get its money back by taking the system.

- Meanwhile, installers get squeezed by these high fees and go out of business.

- Then, systems break with no one to fix them, so homeowners stop paying their loans.

- Consequently, big investors lose confidence and stop providing money to the industry.

We’re already seeing this start. The finance company Sunlight Financial went bankrupt. Now, there are over 2,000 lawsuits against other big lenders. The easy-money era for solar loans is over.

3. Under NEM 3.0, No Battery = No Game

The net metering reform based on California’s NEM 3.0 is spreading everywhere. The grid went from an “unlimited free battery” to a “counterparty.”

Utilities don’t buy your extra power at retail price anymore. The export rate crashed by 75%. You have to send 4-6 kWh to the grid to get 1 kWh of credit back.

Solar-only setups are dead financially. “Solar + Storage” isn’t an option anymore; it’s a requirement. This means installers gotta know storage inside out.

4. Geopolitics: FEOC is Locking China Out

Under the double kill of FEOC rules and tariffs, the path to the U.S. for Chinese solar/storage companies completely changed in 2026.

The smart Chinese companies used the last window before the 2025 subsidy drop to flood overseas warehouses with one last massive shipment, grabbing what market share was left.

In the 2026 new normal, the simple “export products” path is blocked. The Chinese supply chain is speeding up “de-China-fication” packaging—either moving final assembly to places like Southeast Asia, or using equity proxies and complex offshore setups to invisibly control U.S. production capacity and dodge the rules.

Conclusion: Who Survives After 2026?

A major shakeout is coming. Companies that relied on subsidies and financial tricks will disappear. Survivors will need:

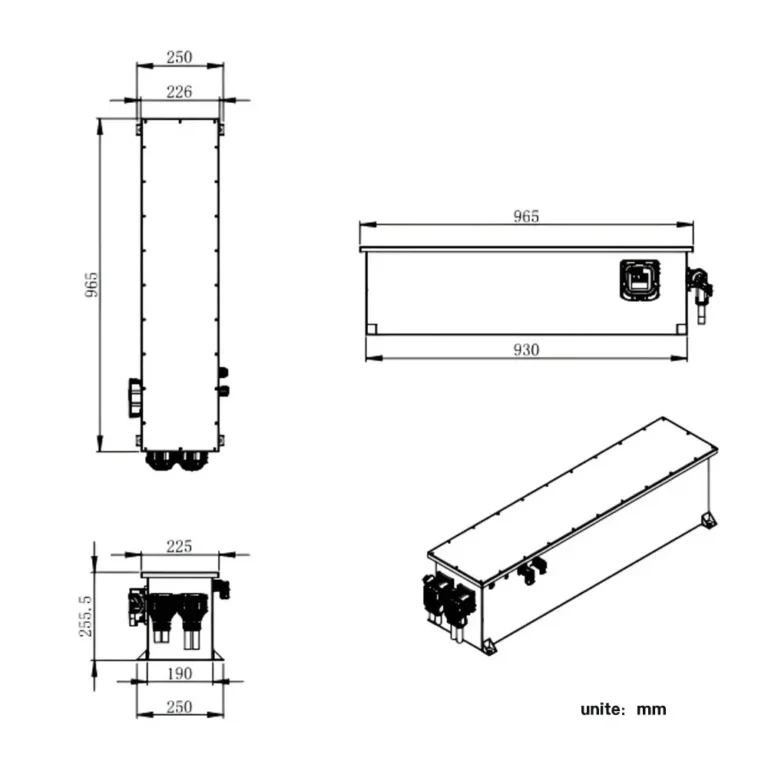

- Robust Products & Technology: Safety and real-world lifespan of batteries are fundamental. Competing on price alone won’t work.

- Strong Local Service Networks: Sales, installation, and maintenance must be integrated. A 25-year warranty requires the ability to service it for 25 years.

- Sustainable Business Models: High-leverage financial games must end. Healthy margins and stable cash flow are non-negotiable.

- Complete Solution Providers: Selling just batteries isn’t enough. Winners will integrate solar, storage, smart energy management, and EV charging into a holistic home energy package.

The growth story for home energy storage isn’t over, but a new chapter begins. The “rapid expansion phase” is giving way to the “consolidation phase.” For serious manufacturers and informed customers, this is positive in the long run. But for a significant portion of the industry, the next two years will be a true test of endurance.

This is the reality facing the U.S. home energy storage market in 2026.