Henan Liyue New Energy Co., Ltd

Base Power: The $1 Billion Bet Reshaping Home Energy Storage

If you’ve been in the energy industry for years like I have, you’ll understand that some companies simply sell products, while others try to reshape the rules of the entire energy system. Base Power undoubtedly belongs to the latter. They are more than just a battery company; they are a compelling case study showcasing a new energy utility model built from scratch for an era of grid instability.

I’ve witnessed countless startups rise and fall, and Base Power stands out not only because of its renowned founders—but also because it focused on a thorny problem and offered an incredibly simple solution, which is crucial. We must be observant and see and solve problems from the perspective of the average user.

A Flash of Inspiration: Solving the Texas Problem

Base Power was born from the 2021 Texas grid collapse. While most of us saw it as a tragedy, its founder, Zach Dell, saw a blueprint for the future. The question isn’t just “How do we guarantee a reliable power supply?”, but rather “How do we make power resilience affordable and accessible to everyone, not a luxury? This is crucial because lithium batteries aren’t cheap.”

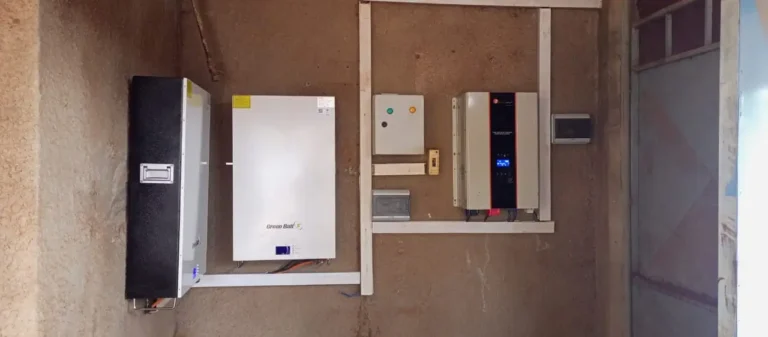

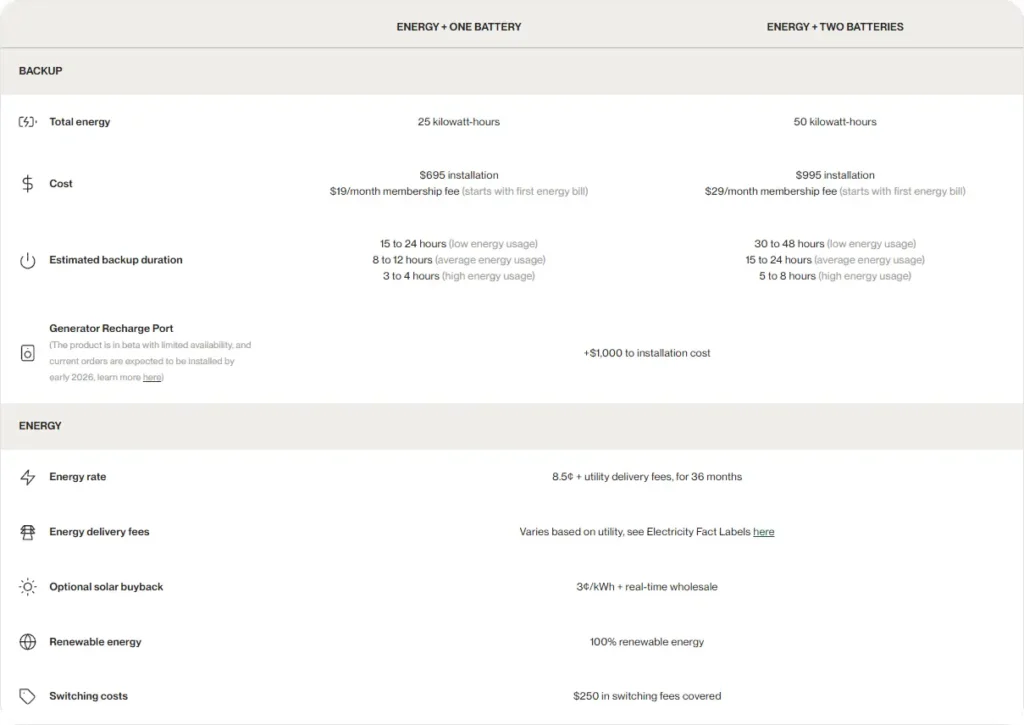

This is the core of their insight. The traditional model—requiring homeowners to pay $15,000 to $20,000 upfront for a solar power system (typically consisting of lithium batteries and an inverter, with additional photovoltaic panels for off-grid systems)—serves only the wealthy. Base Power disrupts this model. What if power resilience could be a subscription service? What if you could install a giant battery in your garage for a fixed monthly fee, guaranteeing uninterrupted power and predictable electricity bills?

This is their core philosophy: They sell certainty.

Deconstructing the Model: This Isn’t a Battery, It’s a Service

Many observers misunderstand this. Calling Base Power a “battery company” is like calling Amazon a “bookstore.” Batteries are a means, not an end.

Their real product is a bundled service consisting of two parts:

- Hardware as a Service: You pay a small upfront fee for a 25kWh battery (a huge capacity for residential users), and then only pay monthly for maintenance and monitoring. They own the equipment.

- Power Plan: You agree to buy electricity from them at a fixed price (usually below market rate) for a three-year term.

The brilliance of this model lies in how it solves problems on two fronts. For customers, it’s simple: one provider, predictable bills, and peace of mind. For Base Power, it’s a dual revenue stream: subscription fees from users and arbitrage revenue from the grid.

Core Operation: Vertical Integration and Extreme Efficiency

However, this model only works if you can tightly control costs. This is where Base Power’s less glamorous but crucial advantage comes in: vertical integration.

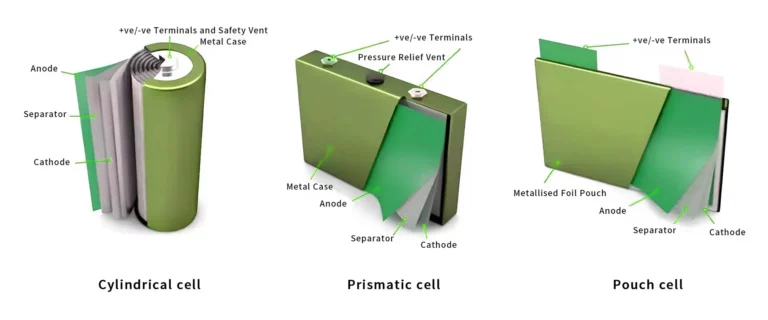

While most competitors are assemblers, simply assembling battery cells and battery management systems (BMS) sourced from third parties and reselling them, Base Power emulates Tesla’s model. They deeply customize the design of battery packs, BMS, enclosure structures, inverters, and, most importantly, built their own factory in Austin. Why? To squeeze every last penny of profit from the hardware. They believe the real profit lies not in the cells themselves, but in the power electronics, battery pack design, and production efficiency.

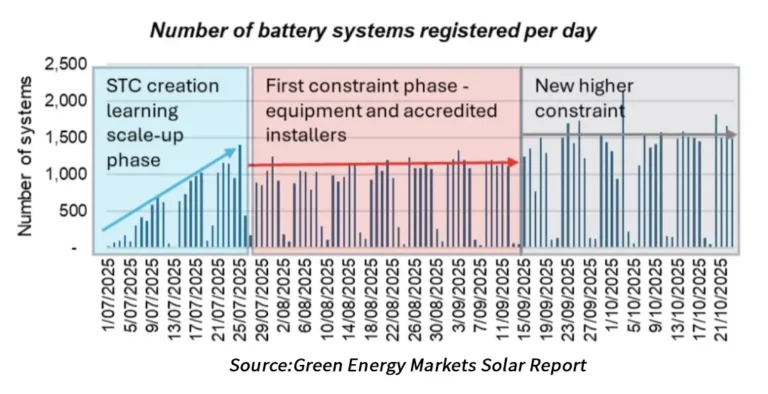

Furthermore, there’s the installation process—historically the most expensive and unreliable part of the home energy industry. Base Power has industrialized this process. They separate the heavy handling (equipment installation) from specialized electrical work, enabling a small team of electricians to complete an astonishing number of installations daily. This is not just incremental improvement; it’s a fundamental restructuring of deployment logistics.

The Magic Secret: Making the Grid Their Partner

The real secret to achieving economic benefits lies in: Virtual Power Plants (VPPs).

Each Base Power battery in a garage is not isolated, but rather a node in a distributed grid-scale battery network. When Texas electricity demand surges—for example, on a sweltering August afternoon—the grid operator (ERCOT) desperately needs power. At this time, Base Power’s software can signal hundreds of batteries to discharge simultaneously, selling the stored energy back to the grid at extremely high prices.

This turns their distributed network of home batteries into a commercial power plant. The revenue generated from these events helps subsidize customers’ low monthly fees. Homeowners gain stability in the power system and cost savings; Base Power and the grid gain flexible and reliable power capacity. It’s a virtuous cycle.

Inevitable Obstacles

Of course, the road is not without its challenges.

- The Sword of Damocles of Regulation: Their entire business is built on the rules of the Texas energy market. Significant changes in how distributed resources are compensated could disrupt their business model.

- The Capital-Intensive Trap: Building the factory and financing thousands of batteries requires substantial capital. Their $1 billion Series C funding round is both a validation of their business model and proof of their exorbitant capital expenditure rate.

Imminent Competitive Impact: Utility companies are recognizing this opportunity. Companies like Green Mountain Power have run successful, though smaller, battery-leasing programs for years. The big tech incumbents—Tesla, Sunrun—won’t cede this space without a fight.

The Bottom Line: What Base Power Represents

Watching Base Power isn’t just about tracking whether one startup succeeds. It’s about watching a beta test for the future of the entire electric grid.

They are proving that a company can be born as a hybrid retailer-asset operator, blurring the lines between a utility and a tech company. They are demonstrating that the future of grid reliability may be built from the bottom up, one home at a time, rather than from the top down with massive centralized power plants.

In the end, Base Power is more than a company. It’s a bold argument that the most resilient grid is one we all own a piece of, and that the future of energy isn’t just cleaner—it’s democratized.