河南礼悦新能源有限公司

荷兰电池储能生存指南:降低荷兰电网费用

荷兰正在经历一场电池储能革命——2024年电池储能容量将翻一番,目前已投入使用的储能容量超过600兆瓦时,另有数千兆瓦时正在开发中。然而,尽管需求飙升,许多项目仍面临着生存威胁:高昂的电网费用使利润暴跌30%甚至更多。德国为加速储能应用而免除了这些费用,而荷兰监管机构却依然固守过时的规则,将电池视为“消费者”,而非重要的电网资产。除非监管机构迅速采取行动,否则这一政策失误可能会阻碍欧洲最具前景的储能市场的发展。

荷兰电池悖论:增长与电网费用

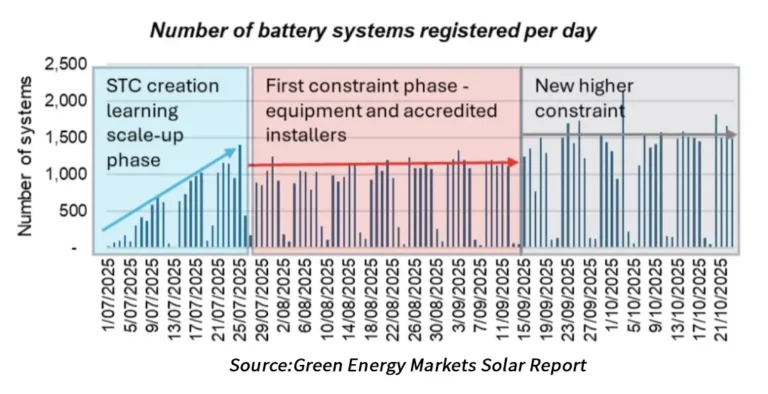

这些数字展现了爆炸式增长的景象。自2023年以来,大型商业和工业电池储能系统(容量超过1兆瓦时)的安装数量从40个激增至84个,总容量跃升至620兆瓦时。另有3000兆瓦时储能系统正在建设中,这得益于荷兰迫切需要平衡其风电和太阳能占主导地位的电网。然而,在这一进步的背后隐藏着一个明显的矛盾:虽然电池储能系统有助于解决电网拥堵问题,但荷兰监管机构却对其征收欧洲最高的费用——高达每兆瓦时23欧元,而德国的费用为0欧元。

这种差异源于监管方面的怪癖。荷兰消费者和市场管理局 (ACM) 将独立电池归类为“消费者”,迫使它们支付高昂的可变输电费。相比之下,德国则免除了储能系统的这些费用,承认其在稳定电网方面的作用。结果如何?荷兰项目的回报期更长,开发商越来越多地将投资转向德国,因为德国的政策积极鼓励储能部署。

这场战斗为何重要

对荷兰来说,电池储能应该是不二之选。该国的电网拥堵是欧洲最严重的之一,太阳能和风能的弃风现象已成常态。电池储能可以吸收多余的可再生能源,并在需要时释放,从而缓解电网过载的压力。然而,荷兰的政策非但没有鼓励这种解决方案,反而对其进行了惩罚。

其财务影响十分严重。对于一个典型的50兆瓦电池系统来说,电网费用每年可能会抵消100万欧元甚至更多的收入——足以决定一个项目的成败。毫不奇怪,开发商正将重点转向混合部署,将电池系统与太阳能或风电场相结合,以完全避免电网费用。目前,荷兰超过80%的新建储能项目都采用这种模式,这清楚地表明了独立电池系统处于劣势。

荷兰可以修正其存储政策吗?

解决方案在于监管改革。荷兰电网运营商TenneT已经引入了一些变通方案,例如 ATR85合同,将灵活运行电池的费用降低了65%。但这只是权宜之计。真正的改变必须来自ACM,它面临着将电池重新归类为“灵活性资产”而非消费者的压力。预计将于2025年12月做出决定——整个行业都在关注。

如果荷兰的政策与德国保持一致,其储能市场可能会爆发式增长,释放数十亿美元的投资。否则,开发商将继续涌向更友好的市场,导致荷兰电网拥堵状况进一步恶化。选择显而易见:要么拥抱电池作为能源转型的一部分,要么眼睁睁地看着这场革命在其他地方发生。