Henan Liyue New Energy Co., Ltd

Australia Household Energy Storage: Why Bigger and Smarter Systems Are Winning

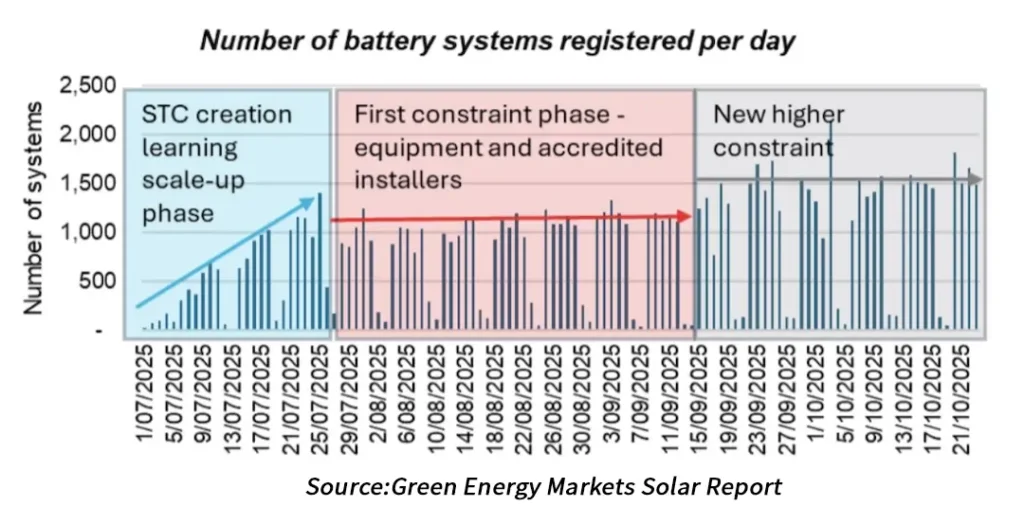

An Unprecedented Surge: Data and Driving Factors

In just 17 weeks, nearly 100,000 home battery systems have been registered in Australia—a deployment rate unprecedented in the history of distributed energy infrastructure development. This surge is attributed to government subsidies, such as the “Cheaper Home Battery Scheme” (offering up to AU$3,000 per household), making Australia a testing ground for residential energy storage globally. However, subsidies alone cannot explain this trend. The following factors are key:

- Grid Instability: Australia’s electricity market is one of the most volatile in the world, with peak prices often exceeding AU$0.40/kWh. Residential users are looking to enhance their ability to cope with power outages and soaring prices.

- Solar Saturation: While 40% of Western Australian homes have rooftop solar systems, energy storage penetration remains below 7%, creating a significant opportunity to store excess solar power.

- Supply Chain Advantages: Chinese manufacturers like Sungrow and SEGG dominate the market due to Australia’s CEC certification requirements and product designs suitable for Virtual Power Plants (VPPs).

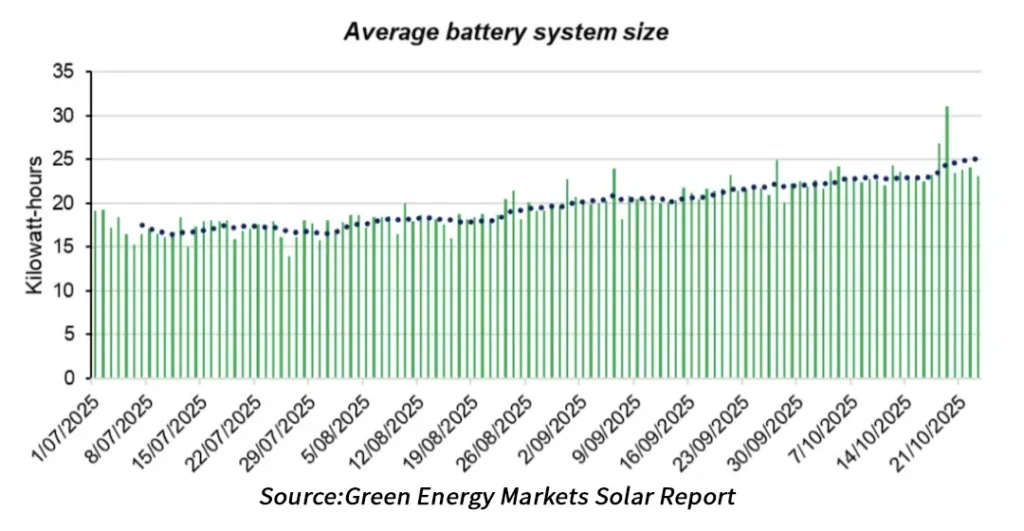

The Economics Behind the Expansion of Energy Storage Capacity

In this energy storage installation frenzy, one phenomenon that fascinates technology observers is that the average capacity of home energy storage systems is expanding at a faster-than-expected rate.

- Cost Structure: Up to 40% of battery system costs are fixed costs (inverters, installation labor). Increasing capacity from 12 kWh to 25 kWh only increases the total cost by about 52%, while energy storage capacity increases by 108%, and the cost per kilowatt-hour decreases by 27%.

- Electric Vehicle Readiness: With the rapid adoption of electric vehicles, households are expected to require 10-15 kWh of charging per vehicle per day. A 25 kWh system can meet the future electrification needs.

- Virtual Power Plant Participation: Greater capacity allows households to maximize the benefits of virtual power plants by storing inexpensive solar energy and selling it during peak electricity demand.

The Virtual Power Plant Revolution: From Backup Power to Grid Asset

Project Jupiter in Western Australia is a prime example, demonstrating how distributed batteries can evolve into grid stabilization assets. By aggregating residential batteries into virtual power plants (VPPs), the initiative aims to:

- Offset Peak Demand: 100,000 batteries discharging simultaneously can provide 500 MW of power, equivalent to the output of a medium-sized gas-fired peaking power plant.

- Reduce Grid Upgrades: In pilot projects, virtual power plants deferred $150 million in grid infrastructure investment.

- Unlock New Revenue: Residential users can earn between $200 and $1,000 annually by selling stored electricity during peak demand periods.

Supply Chain Bottlenecks and Market Dynamics

The booming development of virtual power plants has not been without its challenges. Early registrations are stalled at 1,000 systems per day due to two key constraints:

- Battery supply delays: Orders from Chinese lithium battery manufacturers have lead times of 2 to 4 months.

- Skilled labor shortage: Overwhelmed certified installers have pushed some installation projects back to 2026.

These bottlenecks highlight a broader issue: policy incentives may outpace the supply chain’s readiness, creating temporary supply-demand imbalances.

Challenges and Controversies

- Safety risks: Tesla’s Powerwall 2 recall due to fire hazards underscores the need for stringent standards. Australia’s new SA TS 5398:2025 safety guidelines aim to mitigate these risks.

- Fairness issues: Wealthy households benefit most from subsidies, potentially exacerbating energy inequality.

- Grid complexity: A lack of coordination in battery discharge could disrupt the stability of local distribution networks.

The Path Forward: From Prosperity to Sustainable Transition

Australia’s battery boom is a microcosm of the global energy transition dynamics. Key takeaways:

- Policy Synergies: Subsidies must be combined with market reforms (such as dynamic pricing) to maximize value.

- Supply Chain Localization: Despite abundant lithium resources, Australia remains reliant on imported batteries—a strategic weakness.

- Consumer Empowerment: Tools like Anker’s AI-driven energy management platform make energy storage technology easily accessible to non-technical users.