河南礼悦新能源有限公司

Zafiri 离网投资:$300M 用于非洲 Mission 300 电气化

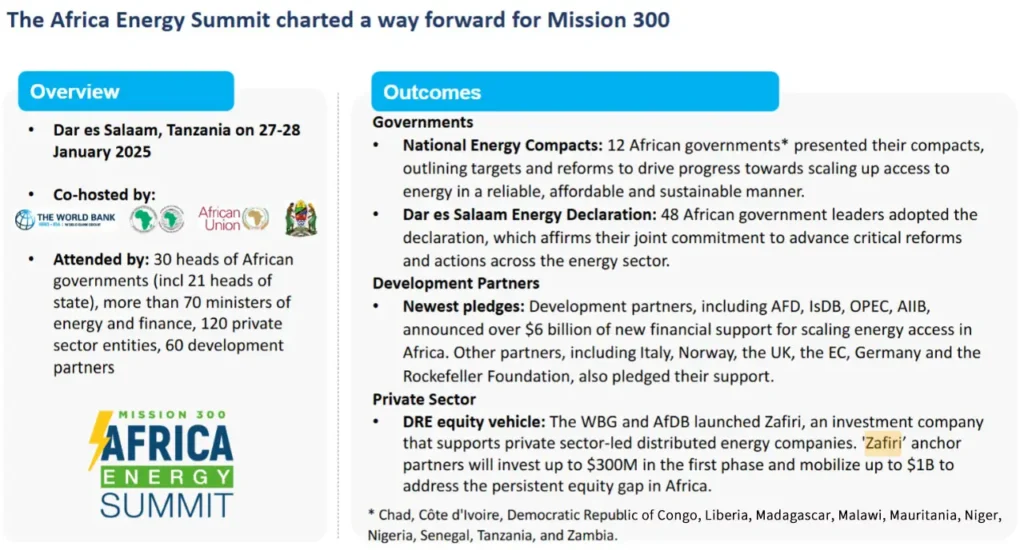

一个名为“Zafiri”的新投资平台计划于今年 7 月在毛里求斯推出,其雄心勃勃的使命是:为撒哈拉以南非洲的离网和分布式可再生能源 (DRE) 解决方案注入长期股权资本。

该计划背后是发展金融机构和慈善组织的强大联盟。其首轮融资已成功募集143亿先令(目标1410亿先令),优先股权和次级股权各占一半。其中,国际金融公司(IFC)将投资高达141.2亿先令,非洲开发银行(AfDB)和洛克菲勒基金会也已加入并成为创始合伙人。值得一提的是,洛克菲勒基金会提供了1410亿先令的催化资本,这也是其在“300使命”倡议下加速清洁能源普及的更广泛承诺的一部分。

Zafiri 的结构突破了传统的债务融资模式。它将为太阳能家用系统供应商、微型和城市电网开发商以及清洁烹饪企业提供长期的股权资本——这些解决方案对于非洲5.7亿仍未用电的人口实现电力供应至关重要。Zafiri 通过其混合融资方式,旨在将商业可行性与发展影响力相结合,利用优先次级股权吸收早期风险,同时以低风险回报吸引私人投资者。

该平台面向拥有商业和工业 (C&I) 承销商的开发商,因为此类项目比单纯依赖分散的农村需求能够提供更稳定的收入来源。该战略旨在加速规模扩张,同时提高这一历来服务不足的细分市场的融资能力。Zafiri 的架构旨在实现长期增长:第二轮融资最多可额外筹集 14 亿欧元,使总资本达到 14 亿欧元,并力争在未来 10 至 15 年内实现 14 亿欧元的净资产。该基金将通过位于毛里求斯的独立投资经理运营,目前仍在遴选合适的投资经理。 Zafiri是“使命300”的核心支柱之一。“使命300”是世界银行和非洲开发银行的一项联合倡议,旨在到2030年为3亿非洲人提供电力。该计划将离网太阳能作为农村电气化成本最低的解决方案,并指出它可以为家庭节省1456亿比索(约合1.4万亿新元)并支持200万家微型企业。Zafiri通过提供灵活的资本和低风险的结构来支持这些目标,以帮助早期开发商在不受短期债务约束的情况下扩大规模。

Zafiri 的成功取决于三个关键因素:吸引有能力的投资经理,实现可衡量的能源可及性和气候成果,以及为未来扩张催化机构资本。如果 Zafiri 在这些方面取得成功,它将成为动员大规模股权投资进入非洲分布式能源领域的权威蓝图。通过将优惠支持与商业雄心相结合,Zafiri 可以证明,精心设计的耐心资本可以改变基础设施融资的模式,为前沿市场开启一个具有韧性和气候韧性的能源系统的新时代。

资料来源:

https://blogs.worldbank.org/en/energy/mission-300–unlocking-capital-for-off-grid-solutions-in-africa https://solarfinanced.africa/updates/new-300-million-blended-finance-platform-targets-off-grid-energy-growth